LMNP (Location Meublée Non Professionnelle): Investment, Taxation, and Property Management

Recommandés

Introduction: LMNP – A Unique Tax System for Property Investors in France

The LMNP (Location Meublée Non Professionnelle) is a tax regime exclusive to France, designed for individuals who rent out furnished properties as non-professional landlords. This system offers significant tax advantages, making it a popular choice for property investors looking to earn rental income while minimizing their tax burden.

What sets LMNP apart is its unique focus on furnished rentals, allowing landlords to benefit from deductions on expenses such as property depreciation, loan interest, and maintenance costs. These deductions often result in little or no taxable income for several years, offering substantial savings for property owners.

Unlike rental regimes in other countries, LMNP is tailored to support small- and medium-scale investors, providing flexibility without the obligations tied to professional landlord status. It’s particularly attractive for those seeking to invest in the French real estate market without becoming full-time property managers. This makes LMNP a prime choice for both domestic and international investors interested in generating rental income in France while benefiting from favorable tax treatment.

The LMNP Status (Statut LMNP)

The LMNP status (Location Meublée Non Professionnelle), or Non-Professional Furnished Rental, is a specific tax regime in France tailored for individuals renting out furnished properties as non-professional landlords. This status offers favorable tax advantages, making it a popular choice for investors looking to generate passive income through real estate.

Under the LMNP regime, rental income is taxed as industrial and commercial profits (BIC – Bénéfices Industriels et Commerciaux). However, one of the main benefits is the ability to deduct a significant portion of expenses such as property depreciation, loan interest, maintenance costs, and more. This often results in reduced taxable income and, in some cases, allows investors to avoid paying taxes on their rental income for several years.

To qualify for LMNP status, the annual rental income should not exceed €23,000, or it must be less than half of the total household income. Additionally, the owner must not be classified as a professional landlord, which differentiates LMNP from the LMP (Loueur en Meublé Professionnel) status, where the income threshold is higher, and certain obligations such as social security contributions apply.

LMNP for Older Properties (LMNP Ancien)

Investing in older properties under the LMNP regime, referred to as LMNP ancien, offers several advantages. Older properties typically have a lower purchase price compared to new builds, and they can often be located in desirable, well-established neighborhoods. This makes them an attractive option for landlords aiming for a stable rental yield with fewer upfront costs.

Moreover, with LMNP ancien, landlords can still benefit from tax advantages, including the ability to amortize the value of the property (excluding the land), furniture, and improvements made to the property over time. This depreciation can be used to offset rental income, reducing the amount of taxable income significantly.

Renovating older properties can also provide additional deductions for the costs of repairs and improvements, which further enhances the fiscal benefits of the LMNP status. However, investors need to ensure that the property is fully compliant with local regulations and standards for furnished rentals to maintain the LMNP status.

Conditions for LMNP Status (LMNP Conditions)

To qualify for the LMNP status, certain conditions must be met:

- Non-Professional Status: The owner must not be considered a professional landlord. This means that the total rental income generated from furnished rentals must not exceed €23,000 per year, or it must be less than half of the owner’s total household income.

- Furnished Rental: The property must be rented fully furnished. This includes providing the tenant with all necessary furniture and appliances to live comfortably, such as beds, tables, chairs, kitchen equipment, and more. The French government has set out a minimum list of required furnishings.

- Property Ownership: The property must be owned directly by the landlord or through certain types of property ownership structures, such as SCI (Société Civile Immobilière) under certain conditions.

- Registration with Authorities: LMNP landlords must register their activity with the Greffe du Tribunal de Commerce and obtain a SIRET number. This is essential for tax reporting purposes.

- Compliance with Local Regulations: The property must comply with local housing regulations, particularly concerning health and safety standards. Failing to meet these conditions could lead to a loss of the LMNP status and the associated tax benefits.

Proving LMNP is a Rectangle

The term “LMNP” is not geometrical, but if you’re asking how one could prove that LMNP represents a rectangle in a theoretical or metaphorical sense, one might consider certain analogies.

In geometry, a rectangle has four sides, and the opposite sides are equal and parallel. If we think of LMNP in terms of having specific components that structure it like a “rectangle,” we might suggest the following “sides”:

- Tax Benefits: One side represents the tax advantages, such as income tax reduction through depreciation.

- Rental Income: Another side is the rental income that LMNP landlords can generate.

- Legal Framework: The third side could represent the legal framework and conditions that define LMNP, such as registration, furnishing standards, and income thresholds.

- Non-Professional Status: The final side would represent the fact that the landlord is non-professional, distinguishing LMNP from other rental statuses like LMP.

Thus, to “prove” LMNP is like a rectangle, we might show how these four sides work together in balance, forming a structured and stable approach to renting furnished properties in France.

Investing in LMNP (Investissement LMNP)

Investing in LMNP (Location Meublée Non Professionnelle) is an attractive option for individuals looking to generate passive income from real estate in France. The LMNP status allows landlords to rent out furnished properties under favorable tax conditions while maintaining non-professional status. Here’s an overview of LMNP as an investment:

Key Benefits of LMNP Investment:

- Tax Efficiency: One of the primary benefits of LMNP is the ability to deduct significant expenses, including loan interest, maintenance costs, and depreciation of the property and furniture. This can lead to substantial tax savings.

- Depreciation: Investors can amortize the value of the property and its furnishings, reducing their taxable rental income. This often results in little to no tax being paid on rental profits for several years.

- Stable Income: Renting out furnished properties under LMNP provides steady rental income. The furnished nature of the rental allows for slightly higher rents than unfurnished properties.

- Flexibility: LMNP is a flexible investment option because it applies to various types of furnished properties, including apartments, student housing, tourism residences, and serviced residences.

- Capital Gains Exemptions: After holding the property for 30 years, capital gains are exempt from taxes, making it a long-term wealth-building strategy.

Types of Properties Suitable for LMNP Investment:

- Student Residences: These properties benefit from high demand in university towns.

- Tourism Residences: Located in popular tourist areas, these properties offer seasonal income with higher rent potential.

- City Apartments: In urban areas, furnished apartments for short- or mid-term rentals to professionals or expatriates are common.

- Senior Residences: These properties cater to older tenants and offer long-term, stable rental contracts.

LMNP Taxation (LMNP Fiscalité)

The fiscal benefits of LMNP (Location Meublée Non Professionnelle) make it a popular real estate investment strategy for non-professional landlords in France. LMNP investors benefit from various deductions and simplified tax regimes that reduce or eliminate taxable income for several years.

Key Aspects of LMNP Fiscalité:

- Micro-BIC Regime: For rental income below €72,600 per year, landlords can choose the Micro-BIC regime, which provides a 50% tax abatement on gross rental income. For tourism properties, the abatement is increased to 71%. This regime is ideal for smaller-scale investors.

- Régime Réel: For landlords with higher rental income or those who prefer to itemize their deductions, the Régime Réel offers the ability to deduct actual expenses, such as loan interest, property depreciation, maintenance, and management fees. This option can result in little to no tax liability.

- Depreciation (Amortissement): One of the most attractive features of LMNP is the ability to amortize the value of the property (excluding the land) and furniture. The building is typically depreciated over 20-40 years, and furniture over 5-10 years. This depreciation can offset rental income, significantly reducing taxable income.

- No Social Charges: As long as rental income is under €23,000 or less than 50% of household income, LMNP investors are not required to pay social charges. This is a significant saving compared to the LMP (Loueur en Meublé Professionnel) regime, where social contributions are mandatory.

- Capital Gains Tax Exemption: LMNP properties benefit from the same capital gains tax exemptions as personal properties. After 30 years of ownership, capital gains become fully exempt from taxation. This makes LMNP a viable long-term investment strategy.

LMNP Property Purchase (LMNP Achat)

When purchasing a property under the LMNP status, there are several important factors to consider. An LMNP property must be furnished and meet the conditions of a rental suitable for residential use. The property can be newly built or an older property, and it can be located in cities, student areas, or tourist zones. Here’s what you need to know when buying an LMNP property:

Steps for LMNP Property Purchase:

Choose the Right Property:

- Location: Selecting a property in a high-demand area is critical. Urban areas, student zones, and tourist regions are ideal because they guarantee higher occupancy rates and rental income.

- Furnishing: The property must be fully furnished to meet the LMNP requirements. The furnishings should include essential household items such as beds, tables, chairs, and kitchen equipment. The French government provides a minimum list of required items.

Tax Optimization:

- Depreciation: When purchasing a property under LMNP, you can benefit from the depreciation of the property and furniture. This amortization will reduce your taxable income over time.

- Deductible Costs: All costs related to the purchase, such as notary fees, loan interest, and property improvements, are deductible from your rental income.

Financing the Purchase:

- Bank Loans: One of the main advantages of LMNP is that loan interest can be deducted from rental income. Many investors use mortgage financing to maximize their tax benefits.

- Leveraging Depreciation: Since the property can be amortized over time, it’s possible to generate rental income that is largely tax-free, particularly in the early years of ownership.

Registration with Authorities:

- After purchasing the property, landlords must register their activity with the Greffe du Tribunal de Commerce to obtain an LMNP status and SIRET number, which is required for tax purposes.

Choosing Between New and Old Property:

- New Properties: New properties come with fewer maintenance costs and often benefit from modern amenities, making them easier to rent out. However, they may have higher upfront costs.

- Old Properties (LMNP Ancien): Older properties are typically cheaper to purchase and can be renovated to increase rental value. However, they may come with higher maintenance costs.

Investing in LMNP offers substantial fiscal benefits for non-professional landlords. From favorable tax regimes like Micro-BIC and Régime Réel, to depreciation on property and furnishings, LMNP is designed to maximize rental income and minimize tax burdens. Whether you invest in new or old properties, or cater to tourists, students, or professionals, LMNP provides a flexible and profitable real estate investment option.

How does LMNP compare to LMP?

The LMNP (Location Meublée Non Professionnelle) and LMP (Loueur en Meublé Professionnel) statuses in France are both tax regimes designed for landlords who rent out furnished properties, but they have significant differences in terms of eligibility, taxation, and benefits. Here’s a comparison of the two:

1. Eligibility Requirements

LMNP (Non-Professional Furnished Rental):

- Income Threshold: To qualify for LMNP status, rental income from furnished properties must be less than €23,000 per year or less than 50% of the total household income.

- Non-Professional Status: The landlord must not be classified as a professional, meaning that the rental activity is not their primary source of income.

LMP (Professional Furnished Rental):

- Income Threshold: For LMP status, the landlord’s rental income must exceed €23,000 per year and also be more than 50% of the total household income.

- Professional Status: LMP landlords are considered professional landlords. They are required to pay social contributions and are considered self-employed under French law.

2. Tax Treatment

LMNP (Tax Treatment):

- Amortization: Under the Régime Réel, LMNP landlords can deduct property depreciation and furniture amortization, which often results in significantly reduced taxable income.

- Micro-BIC: For rental income below €72,600, LMNP landlords can opt for the Micro-BIC regime, which offers a 50% tax abatement on gross rental income (71% for tourism properties), simplifying tax filings.

- No Social Contributions: LMNP landlords do not have to pay social contributions unless their rental income exceeds €23,000 or more than 50% of their household income.

LMP (Tax Treatment):

- Amortization: Like LMNP, LMP landlords can amortize the value of the property and furniture, but the scale is larger due to higher rental income.

- Loss Carry Forward: LMP landlords can carry forward rental losses and offset them against other forms of income, such as salaries or business profits, which is not available under LMNP.

- Social Contributions: LMP landlords must pay social contributions (cotisations sociales) on their rental income. These contributions are similar to those paid by self-employed individuals.

- Capital Gains Tax: LMP properties may qualify for exemptions from capital gains tax if the rental activity is carried out for more than five years and generates annual income below certain thresholds. LMNP properties only benefit from capital gains tax exemptions after 30 years of ownership.

3. Social Contributions

LMNP:

- LMNP landlords do not pay social contributions as long as their income does not exceed €23,000 or is less than 50% of household income. This provides a major tax advantage over LMP.

LMP:

- LMP landlords are subject to social security contributions on their rental income. These contributions can range from 17% to 45%, depending on the income level. However, they also benefit from social security coverage, which can be an advantage for some.

4. Capital Gains Tax (CGT)

LMNP:

- LMNP properties are treated similarly to personal properties for capital gains tax. After 30 years of ownership, the capital gains tax is fully exempt. There are partial exemptions before that time, depending on the duration of ownership.

LMP:

- LMP properties benefit from more favorable capital gains tax exemptions. After five years of rental activity, if the rental income is less than €90,000 per year, the property can qualify for a full capital gains tax exemption upon sale.

5. Deduction of Rental Losses

LMNP:

- Rental losses can only be carried forward and used to offset future rental income. LMNP landlords cannot deduct these losses from their total income.

LMP:

- LMP landlords can deduct rental losses from other types of income, such as wages or business profits, reducing overall tax liability. This makes LMP particularly attractive for high-income individuals looking to minimize their total taxable income.

6. Inheritance Tax (Succession)

LMNP:

- LMNP properties do not offer any specific inheritance tax benefits.

LMP:

- LMP properties can benefit from inheritance tax reductions. When passing on LMP properties to heirs, part of the property’s value can be exempt from inheritance tax if certain conditions are met (e.g., the activity is continued by the heirs for a specific period).

7. Accounting Requirements

LMNP:

- Accounting under the LMNP status is relatively simple, especially under the Micro-BIC regime, where a 50% abatement on rental income applies, and there is no need to itemize expenses. Under the Régime Réel, landlords need to maintain more detailed accounts but are not required to meet the same level of accounting complexity as LMP.

LMP:

- LMP requires more detailed accounting because the rental activity is treated as a professional business. This includes maintaining proper profit and loss statements, balance sheets, and regular financial reporting.

Summary of LMNP vs. LMP

| Criteria | LMNP | LMP |

|---|---|---|

| Eligibility | Income < €23,000/year OR < 50% of total income | Income > €23,000/year AND > 50% of total income |

| Taxation Regime | Micro-BIC (50% abatement) or Régime Réel | Régime Réel (deductions, amortization) |

| Depreciation | Yes, on property and furniture | Yes, on property and furniture |

| Social Contributions | No (unless income exceeds €23,000/year) | Yes, mandatory social contributions |

| Capital Gains | Exempt after 30 years | Potential exemption after 5 years, income-dependent |

| Loss Deduction | Losses carried forward against rental income | Losses deductible against total income |

| Inheritance Benefits | None | Inheritance tax reductions possible |

| Accounting Requirements | Simplified, especially under Micro-BIC | Full business accounting |

- LMNP is ideal for smaller investors or those seeking a low-maintenance, tax-efficient real estate investment. It offers attractive tax advantages, especially through depreciation and the Micro-BIC regime, without the burden of social contributions.

- LMP, on the other hand, is suited for larger-scale investors or those who generate significant rental income. While LMP comes with more administrative requirements and social contributions, it allows for greater tax benefits, including the ability to offset losses against other income and more favorable capital gains exemptions.

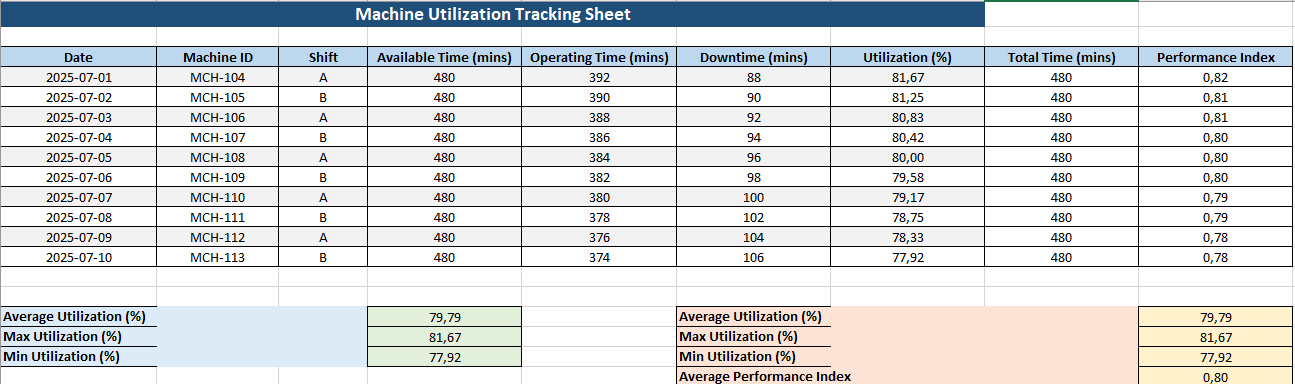

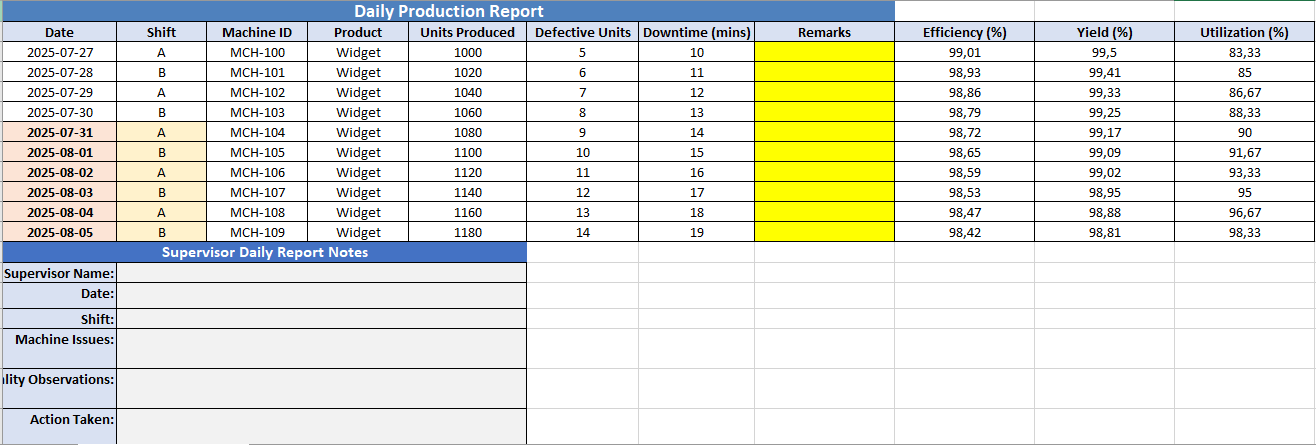

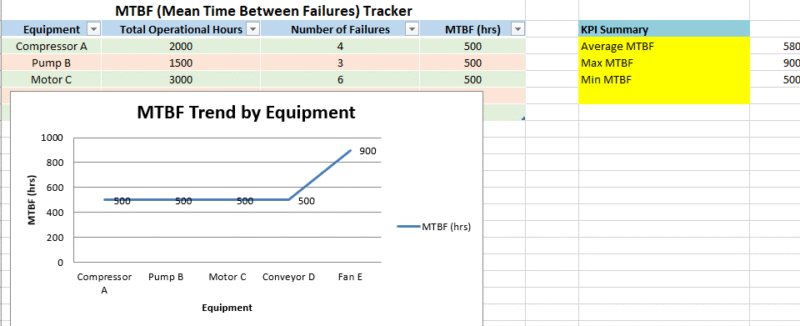

LMNP Management Excel Template User Guide

This guide will help you use the LMNP Management Excel Template effectively. The template is designed to simplify the management of your Location Meublée Non Professionnelle (LMNP) properties by automating key tasks such as tracking rental income, amortization, deductible expenses, and VAT.

1. Title Page

The template opens with a Title Page that includes the name of the document and a brief description. This page is purely informational and sets the context for the template’s purpose: managing LMNP properties.

- Content: Overview of the template’s purpose, date of creation, and a brief description.

- Action: No actions required here; it is for reference only.

2. Rent Tracking Sheet

Purpose:

Track your monthly rental income and automatically calculate the total rent received.

How to Use:

- Date: Enter the date of each rental payment.

- Rent Amount (€): Input the amount of rent due for that period.

- Payment Received (Yes/No): Select “Yes” if the rent was received; otherwise, select “No.”

- Comments: Add any relevant notes (e.g., delayed payment or tenant issues).

- Total Rent Received (€): This column is automatically calculated based on whether the rent was received. If “Yes,” the rent amount is added; if “No,” it is recorded as zero.

Automation:

- The “Total Rent Received” column automatically sums the rent received when “Yes” is selected.

3. Amortization Schedule Sheet

Purpose:

Manage the depreciation of assets (e.g., the property and furniture) over time to calculate the remaining value of each asset.

How to Use:

- Asset: List the assets you wish to depreciate (e.g., apartment, furniture).

- Initial Value (€): Enter the initial purchase value of each asset.

- Depreciation Duration (Years): Input the number of years over which the asset will be depreciated.

- Annual Depreciation (€): This is the yearly depreciation amount for each asset.

- Remaining Value (€): This column is automatically calculated to show the current value of the asset after depreciation.

Automation:

- The “Remaining Value” column uses the formula to subtract the annual depreciation from the initial value based on the current date.

4. Deductible Expenses Sheet

Purpose:

Track and validate all expenses that are deductible for tax purposes.

How to Use:

- Expense Type: Enter the type of expense (e.g., loan interest, repairs, insurance).

- Amount (€): Input the expense amount.

- Date: Record the date the expense was incurred.

- Receipt (Yes/No): Indicate whether you have a receipt or documentation for the expense.

- Comments: Add any additional notes (e.g., missing receipt or specific details).

- Valid Expense (€): This column automatically calculates the deductible amount only if the receipt is marked as “Yes.”

Automation:

- The “Valid Expense” column automatically enters the expense amount if the receipt is available, ensuring you only deduct valid expenses.

5. VAT Management Sheet

Purpose:

Track the VAT (Value-Added Tax) collected and deducted on your LMNP activity.

How to Use:

- Date: Enter the date of each transaction.

- VAT Collected (€): Input the VAT collected from rent or sales.

- VAT Deductible (€): Enter the VAT that can be deducted from purchases or expenses.

- Comments: Add any relevant notes.

- VAT to Pay (€): This column is automatically calculated, subtracting the VAT deductible from the VAT collected.

Automation:

- The “VAT to Pay” column automatically calculates the VAT liability by deducting the deductible VAT from the VAT collected.

General Tips:

- Adding New Rows: If you need to add more rows, simply insert new rows below the existing data and copy the formulas from the previous rows.

- Ensure Data Accuracy: Double-check that all relevant data, such as rent received and expenses, are correctly entered to ensure the formulas work as expected.

- Review Formulas: Each formula is designed to simplify your work. Make sure not to overwrite the formula cells unless necessary.

By following this guide, you can efficiently manage your LMNP properties and streamline your rental and expense tracking. The automated formulas will save you time and reduce errors, helping you optimize your investment’s tax advantages.